South Carolina’s Tax Free Weekend in 2025 is about to make back-to-school, renovations, and shopping sprees a lot more affordable. It is not just a blip on the calendar, either. Shoppers saved millions in sales tax during this event last year alone. Most people get excited for deals on clothing and school supplies. The real surprise? Homeowners, college students, and even small businesses can all cash in on special purchases that go way beyond pencils and shoes.

Table of Contents

- Key Dates And Rules For Tax Free Weekend 2025

- Eligible Purchases For Different South Carolina Residents

- Smart Shopping Strategies For Families, Students, And Businesses

- Extra Savings Tips For Renovators, Movers, And Contractors

Quick Summary

| Takeaway | Explanation |

|---|---|

| Tax Free Weekend is August 1-3, 2025 | South Carolina’s annual tax-exempt event allows residents to save on qualifying purchases for three days. |

| Specific items qualify for tax exemption | Eligible items include clothing, school supplies, and certain electronics, each with price limits. |

| Plan purchases to maximize savings | Create a shopping list based on tax-exempt items, prioritizing genuine needs over optional buys. |

| Different rules apply for professionals | Contractors and businesses must distinguish personal purchases from business ones to qualify for tax exemptions. |

| Keep receipts for tax documentation | Retain all purchase receipts to validate tax-exempt items and ensure compliance with state guidelines. |

Key Dates and Rules for Tax Free Weekend 2025

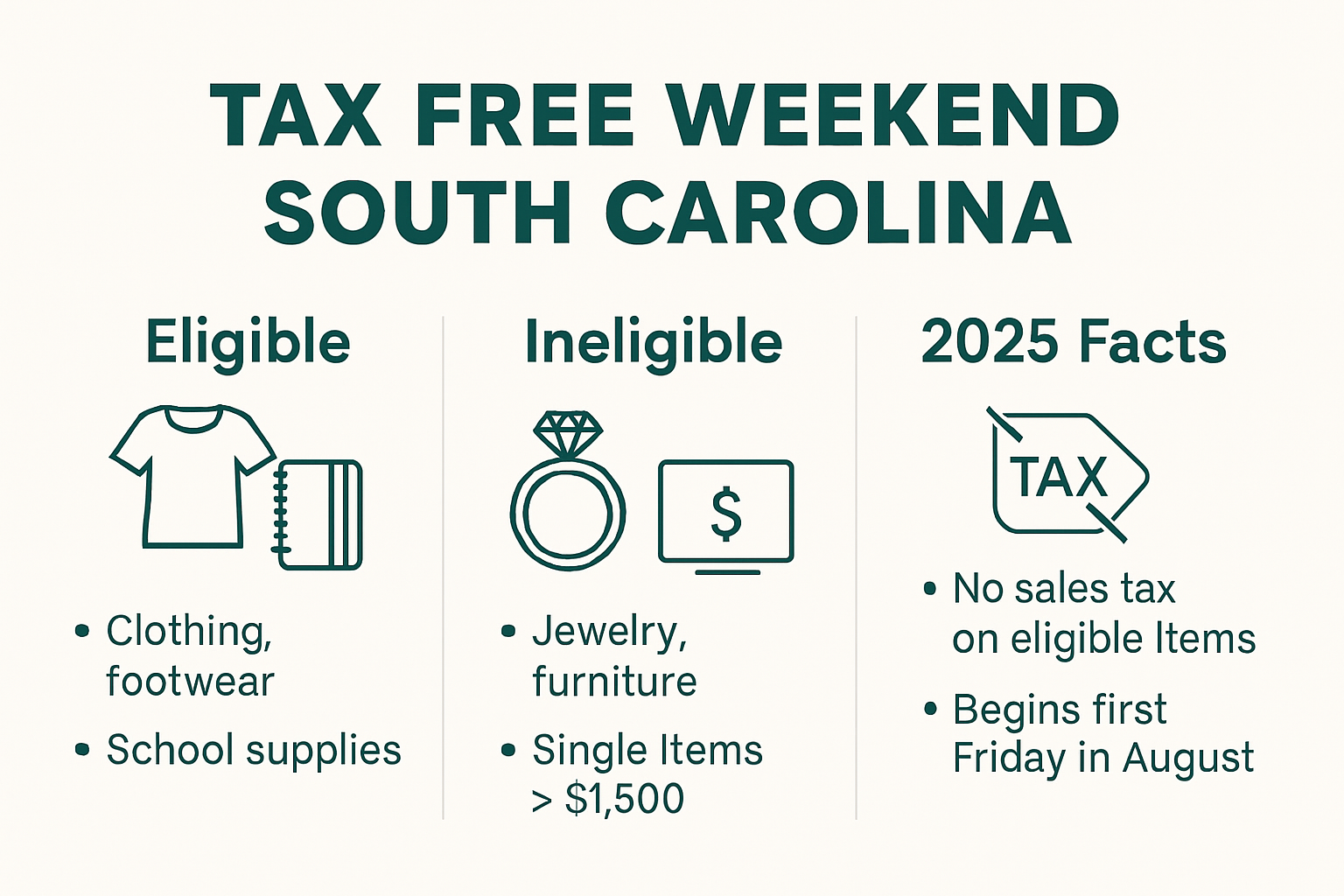

South Carolina residents are gearing up for the highly anticipated Tax Free Weekend in 2025, a strategic opportunity to save money on essential purchases. South Carolina Department of Revenue has confirmed the official dates for this money-saving event, running from Friday, August 1st through Sunday, August 3rd.

Understanding the Tax Exemption Window

During this three-day period, shoppers can take advantage of significant savings by purchasing qualifying items without paying the state’s 6% sales tax. The timing is perfect for families preparing for back-to-school shopping, home improvements, and seasonal wardrobe updates. South Carolina Tax Free Weekend Guidelines provide comprehensive details about which items qualify for tax exemption.

The tax-free weekend applies to a wide range of products, including:

- Clothing and Accessories: Any individual clothing item priced at $100 or less

- School Supplies: Educational items under $100

- Computers and Technology: Qualifying electronic devices with a price limit

- Certain Bed and Bath Items: Specific home goods meeting the exemption criteria

Important Purchasing Guidelines

While the tax-free weekend offers substantial savings, shoppers must be aware of specific rules. Not all items are eligible for tax exemption, and there are precise price thresholds that determine whether a product qualifies. For instance, clothing items must be under $100 per piece to be tax-free. Expensive designer pieces or items exceeding the price limit will still be subject to standard sales tax.

Retailers across South Carolina will be prepared to handle these tax-exempt transactions, but consumers should keep receipts and understand the exact guidelines. Some online purchases may also qualify, provided they are delivered during the tax-free weekend period.

Planning ahead is crucial. Families and individuals looking to maximize their savings should create shopping lists in advance, focusing on items that meet the tax exemption criteria. Whether you’re a student preparing for the upcoming academic year, a parent outfitting growing children, or a homeowner looking to make strategic purchases, the 2025 Tax Free Weekend presents a valuable opportunity to save money.

Remember that while the state provides a tax exemption, local municipalities might have additional regulations. Always check with local authorities or the South Carolina Department of Revenue for the most up-to-date and precise information regarding tax-free purchases.

Eligible Purchases for Different South Carolina Residents

The Tax Free Weekend in South Carolina offers unique opportunities for various residents to save money on essential purchases. South Carolina Department of Revenue provides comprehensive guidelines that cater to different groups, ensuring everyone can take advantage of this tax-saving event.

Students and Families: Back-to-School Essentials

For students and families, the tax-free weekend is a financial lifesaver. South Carolina Tax Regulations confirms that eligible school-related purchases include:

- Clothing and Footwear: Individual items priced at $100 or less

- School Supplies: Educational items under $100, such as notebooks, pencils, backpacks

- Electronics: Computers and related accessories meeting specific price criteria

College students preparing for the upcoming academic year can particularly benefit. Laptops, tablets, textbooks, and dorm room essentials often qualify for tax exemption, helping families manage the significant expenses associated with education.

Homeowners and Professionals: Strategic Purchasing Opportunities

Homeowners and professionals can strategically plan their purchases during this tax-free period. While some home improvement items have restrictions, many practical items are eligible. Professional attire, work-related technology, and certain home office supplies can be purchased without additional tax burden.

Businesses and entrepreneurs can also leverage this weekend for strategic procurement. From updating professional wardrobes to acquiring computer equipment, the tax savings can be substantial. Check our guide on strategic relocation and storage solutions for additional insights on managing business transitions.

Small Business and Military Families: Expanded Savings

Small business owners and military families have unique opportunities during the tax-free weekend. Military personnel can save on uniform replacements, professional clothing, and essential technology. Small business owners can purchase office supplies, computers, and work-related clothing without paying sales tax.

Special considerations exist for these groups. Some professional equipment and specialized clothing might have different tax exemption rules. Always verify specific guidelines with the South Carolina Department of Revenue to maximize your savings.

Whether you’re a student preparing for school, a homeowner making strategic purchases, or a professional planning business investments, the 2025 Tax Free Weekend provides a valuable opportunity to save money. Careful planning and understanding of the guidelines will help you make the most of this tax-saving event.

Remember to keep receipts, understand price thresholds, and check the most current guidelines from official sources to ensure your purchases qualify for tax exemption.

Here’s a quick reference table summarizing what common groups can purchase tax-free and some example items:

| Group | Example Tax-Free Purchases | Price Limits/Notes |

|---|---|---|

| Students & Families | Clothing, school supplies, computers, backpacks | $100/item clothing, $100 supplies |

| College Students | Laptops, tablets, textbooks, dorm essentials | Electronics: qualify under set limits |

| Homeowners | Bed & bath items, some home office supplies | Must meet exemption criteria |

| Professionals | Professional attire, work-related tech/supplies | Excludes most professional tools |

| Small Business Owners | Office supplies, computers, business clothing | Personal vs. business use matters |

| Military Families | Uniforms, professional clothing, tech items | Excludes specialized equipment |

Smart Shopping Strategies for Families, Students, and Businesses

Maximizing savings during South Carolina’s Tax Free Weekend requires strategic planning and informed decision-making. South Carolina Department of Consumer Affairs recommends several key approaches to make the most of this tax-saving opportunity.

Preparation and Budgeting

Successful tax-free shopping starts with careful preparation. Kiplinger’s financial experts suggest creating a comprehensive shopping list before the event. This approach helps residents avoid impulse purchases and stay focused on essential items. Families should inventory existing supplies and identify genuine needs, particularly for students preparing for the upcoming academic year.

Key preparation strategies include:

- Inventory Existing Items: Check what you already own to avoid unnecessary purchases

- Set a Realistic Budget: Determine spending limits in advance

- Research Qualifying Items: Review the detailed list of tax-exempt products

- Compare Prices: Check prices across multiple retailers to ensure genuine savings

To help you strategize your shopping, here’s an overview table of recommended steps for preparing for Tax Free Weekend:

| Step | Description |

|---|---|

| Inventory Existing Items | Check closets, supplies, and tech to avoid duplicates |

| Set a Budget | Decide how much you can afford to spend |

| Research Qualifying Items | Review eligible tax-free items and price thresholds |

| Make a Shopping List | List priority purchases to stay focused |

| Compare Retailer Prices | Shop around to get the best deals |

| Plan for Receipts | Keep receipts for tax documentation and returns |

Maximizing Savings for Different Groups

Each group can approach the tax-free weekend with unique strategies. Students might focus on technology and school supplies, while businesses could plan equipment purchases. Learn more about strategic storage solutions for business transitions to complement your tax-free weekend shopping.

Specific strategies for different groups include:

- Students: Prioritize essential electronics, textbooks, and dorm room supplies

- Families: Focus on clothing, school supplies, and back-to-school essentials

- Businesses: Consider purchasing office equipment, professional attire, and technology

Smart Shopping Tips and Considerations

Beyond basic preparation, shoppers should consider additional tactics to maximize their savings. The South Carolina Department of Revenue emphasizes the importance of understanding specific purchase guidelines. This means carefully checking price limits, qualifying item categories, and potential restrictions.

Practical tips include:

- Keep detailed receipts for all purchases

- Understand exact price thresholds for tax exemption

- Check return policies for tax-free items

- Consider online purchases that qualify during the weekend

Whether you’re a college student outfitting a dorm room, a family preparing for back-to-school, or a business owner making strategic purchases, the 2025 Tax Free Weekend offers a valuable opportunity to save money. Careful planning, budget-conscious decision-making, and a clear understanding of the guidelines will help you make the most of this financial benefit.

Remember that while the tax savings are attractive, the most important strategy is to purchase only what you genuinely need. Avoid the temptation to overspend simply because an item is tax-free.

Extra Savings Tips for Renovators, Movers, and Contractors

South Carolina’s Tax Free Weekend presents unique opportunities for renovators, movers, and contractors to strategically manage expenses. Federation of Tax Administrators highlights specific guidelines that can help these professionals maximize potential savings during the August 1-3, 2025 event.

Navigating Personal vs Professional Purchases

Understanding the critical distinction between personal and professional purchases is essential. South Carolina Department of Revenue emphasizes that while personal items are tax-exempt, tools and materials intended for trade or business use do not qualify for tax exemption. This means contractors must carefully separate personal and professional purchases.

Key considerations for professionals include:

- Personal Clothing: Tax-free for individual use

- Home Office Supplies: Potentially eligible for tax exemption

- Professional Tools: Not covered under tax-free weekend rules

- Safety Equipment: Varies based on personal vs professional classification

To clarify these differences, the following table compares common personal and professional purchases and their tax-free status:

| Purchase Type | Example Items | Tax-Free Status |

|---|---|---|

| Personal Clothing | Shirts, pants, non-uniforms | Yes (if $100 or less) |

| Home Office Supplies | Pens, printer paper, desk lamp | Yes (if qualifying) |

| Professional Tools | Hammers, drills, tool belts | No |

| Safety Equipment | Work boots, safety vests | May vary; check details |

| Home Decor | Bedding, towels, curtains | Yes (if qualifying) |

Strategic Home Renovation Planning

Homeowners undertaking renovation projects can leverage the tax-free weekend for select purchases. Learn about smart temporary storage solutions during renovations to complement your tax-saving strategy. While professional construction materials remain taxable, certain home-related items like bed and bath accessories can be purchased tax-free.

Renovation-related tax-free items might include:

- Bedding and Linens: Sheets, bedspreads, pillows

- Bathroom Accessories: Shower curtains, towels

- Home Decor: Certain qualifying items under specific price points

Smart Purchasing Strategies for Movers and Contractors

Avalara’s tax experts recommend detailed planning to maximize potential savings. While professional equipment remains taxable, movers and contractors can strategically time personal purchases during the tax-free weekend.

Recommended strategies include:

- Separate personal and professional shopping lists

- Research exact tax exemption guidelines

- Purchase personal items during the tax-free period

- Keep meticulous receipts for potential tax documentation

Renovators, movers, and contractors should approach the Tax Free Weekend with a calculated mindset. While professional expenses remain taxable, strategic personal purchasing can yield meaningful savings. Always consult with local tax professionals and review the most current South Carolina Department of Revenue guidelines to ensure compliance and maximize potential benefits.

Remember that thorough preparation and understanding of specific tax exemption rules are key to making the most of this financial opportunity. The goal is not just saving money, but doing so intelligently and in full compliance with state regulations.

Frequently Asked Questions

What are the dates for South Carolina’s Tax Free Weekend 2025?

The Tax Free Weekend in South Carolina will be held from August 1 to August 3, 2025, allowing residents to make qualifying purchases without paying sales tax.

What items are eligible for tax exemption during Tax Free Weekend?

Eligible items include clothing priced at $100 or less, school supplies under $100, and certain electronics and bed and bath items. Always check the specific price limits and regulations for qualifying products.

Can small businesses benefit from the Tax Free Weekend?

Yes, small businesses can take advantage of the Tax Free Weekend by purchasing eligible office supplies, computers, and work-related clothing without paying sales tax, provided the items meet exemption criteria.

How can I prepare for Tax Free Weekend to maximize my savings?

To prepare, create a shopping list of qualifying items, set a budget, compare prices across multiple retailers, and keep receipts for all tax-exempt purchases to ensure compliance with state guidelines.

Make Your Tax-Free Weekend Purchases Work Smarter With STOMO

You plan your shopping down to the last detail to make the most of South Carolina’s Tax Free Weekend. But once those savings kick in, where will you keep all the new purchases when your home or office is filled with back-to-school gear, renovation supplies, or new business equipment? Have you thought about storage or moving help to actually make your tax-free wins matter in everyday life? We make it simple for South Carolinians to save money and stay organized during this busy shopping season. For more local tips and solutions, visit our Uncategorized – STOMO Mobile Storage and MOVEMO Moving Service category.

Stay ahead and stress-free by choosing a local, family-owned provider with award-winning customer care. Whether you need temporary storage for renovation materials, help with college moves, or want your valuables kept safe after scoring tax-free deals, STOMO delivers flexible, weather-resistant portable storage right to you. Reach out now so your tax-free finds do not create more clutter or headaches—let our team help you use every dollar wisely. Book storage or moving solutions today while demand is high during tax-free season.

Recommended

- Relocation to South Carolina: 2025 Guide for Homeowners, Students & Businesses – STOMO Mobile Storage and MOVEMO Moving Service

- University of South Carolina Storage and Moving Solutions 2025 – STOMO Mobile Storage and MOVEMO Moving Service

- Charleston South Carolina USA: Storage & Moving Solutions 2025 – STOMO Mobile Storage and MOVEMO Moving Service

- What Is Portable Storage? 2025 Guide for Moves, Renovations, and Businesses – STOMO Mobile Storage and MOVEMO Moving Service